|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

How to Refinance Your Home: Key Information and Steps to FollowRefinancing your home can be a strategic financial move, allowing you to take advantage of better interest rates, reduce monthly payments, or tap into your home's equity. Understanding the process is crucial for making informed decisions. Understanding the Basics of RefinancingRefinancing involves replacing your existing mortgage with a new one, ideally with more favorable terms. This can be done for various reasons, each with its own set of considerations. Reasons to Refinance

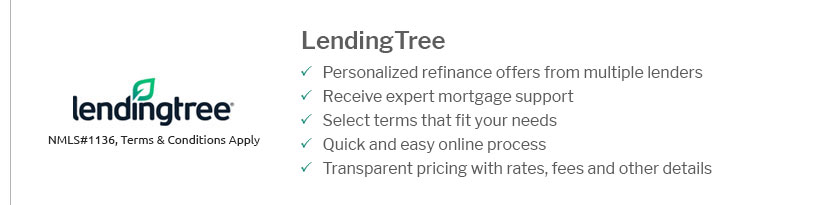

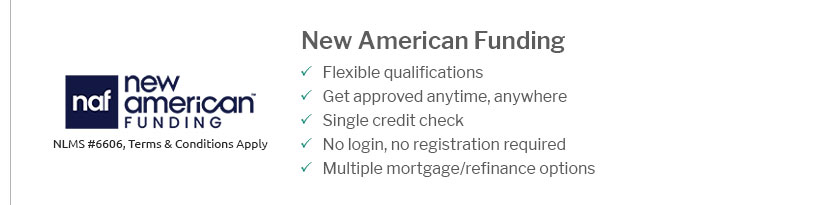

When to Consider RefinancingTiming can impact the success of your refinancing. Consider refinancing if interest rates have dropped significantly since you took out your original mortgage, or if your credit score has improved. Steps to Refinance Your HomeAssess Your Financial SituationEvaluate your current mortgage terms, financial goals, and credit score. This assessment helps determine if refinancing aligns with your financial strategy. Research and Compare LendersShop around for the best rates and terms. Comparing different lenders can save you money in the long run. Consider options like refinance mortgage with no points for potentially lower costs. Apply for Refinancing

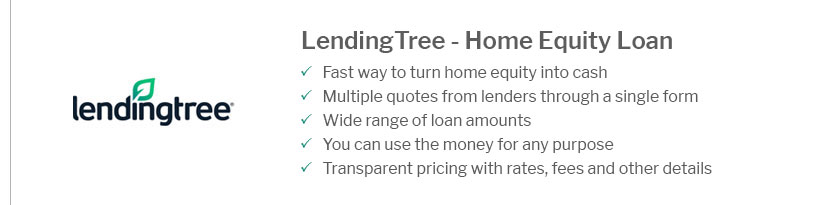

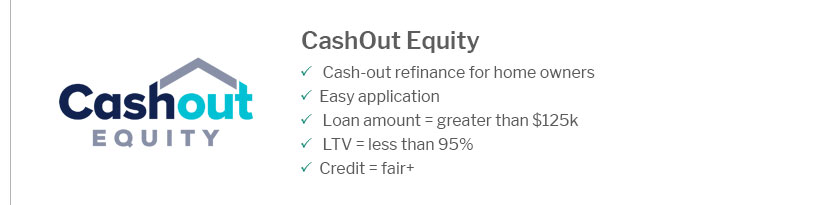

Once approved, your new lender will pay off your old mortgage, and you will start making payments under the new terms. Refinancing Options for Different SituationsRefinancing with Poor CreditIf your credit score is less than ideal, you still have options. Consider specialized lenders who offer refinance mortgage with poor credit rating solutions. Cash-Out RefinancingThis option allows you to take out a new mortgage for more than you owe, using the difference for financial needs like home improvements or debt consolidation. FAQWhat are the costs associated with refinancing?Refinancing costs can include application fees, appraisal fees, and closing costs, typically ranging from 2% to 5% of the loan amount. How does my credit score affect refinancing?A higher credit score can qualify you for better interest rates and loan terms, while a lower score might limit your options or result in higher rates. By understanding these key points and following a structured approach, refinancing your home can be a smooth and beneficial process. https://www.rocketmortgage.com/refinance/get-started

Your refinance application starts here. - Rocket Homes. Get a real estate agent handpicked for you and search the latest home listings. - Rocket Mortgage. Buy a ... https://www.ramseysolutions.com/real-estate/refinancing-mortgage?srsltid=AfmBOoruK_9OD_C7SnXQHdv5NqDIgDq2fnQtnzdzAGNNwzniYvph25Vn

Mortgage refinancing is replacing your existing mortgage with a new mortgage, usually to get a better interest rate. https://www.bankofamerica.com/mortgage/refinance/

Today's competitive refinance rates ; Rate - 7.125% - 6.125% - 7.250% ; APR - 7.311% - 6.453% - 7.382% ; Points - 0.710 - 0.942 - 0.887.

|

|---|